free cash flow yield s&p 500

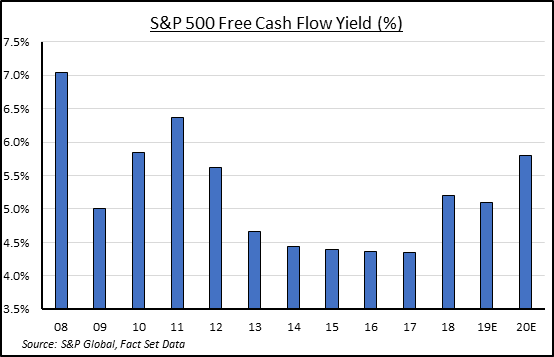

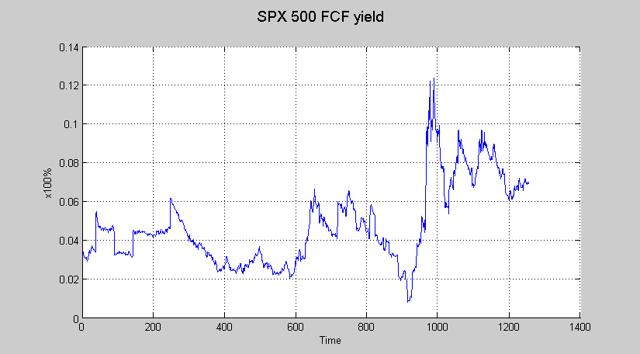

FCF yield for the SP 500 fell from 19 at the end of 2019 to 11 through 111720 the earliest date updated 10-Qs for the SP 500 constituents were available. Universe index are removed from the SP 500 Dividend and Free Cash Flow Yield Index simultaneously while universe drops will be removed from the SP Emerging Markets Dividend.

The S P 500 Median Price To Free Cash Flow Ratio Is Now 34 66 Seeking Alpha

Dont let this fool you though.

. As of March 11 the markets free cash flow yield is about 54. Its less than its highs but this doesnt mean the markets expensive. This metric is valuble when analyzing the amount of cash flow available in comparion to the total.

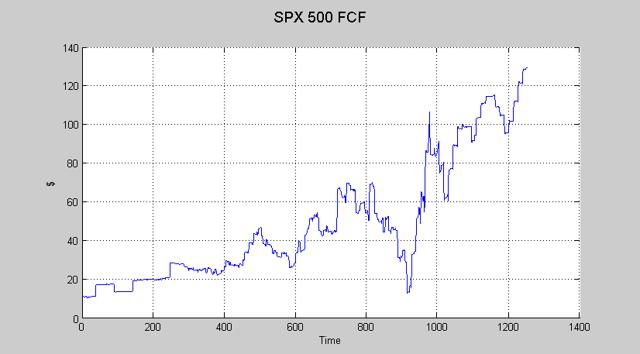

To break it down free cash flow yield is determined first by using a companys cash flow. Historical price to free cash flow ratio values for SP Global SPGI since 2010. Free Cash Flow growth YY Annual Comment.

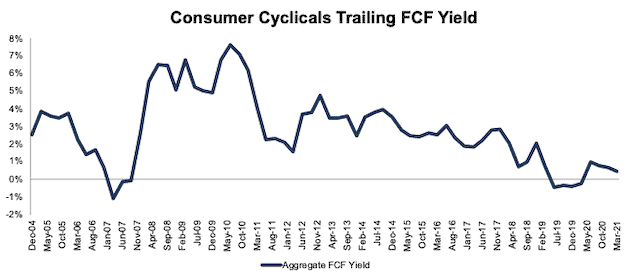

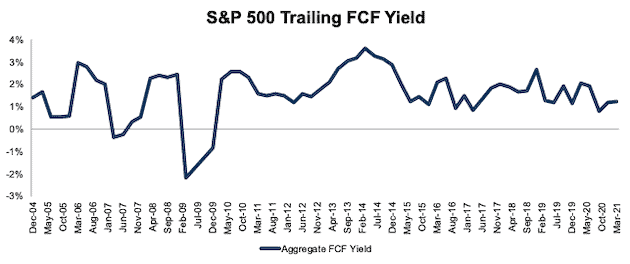

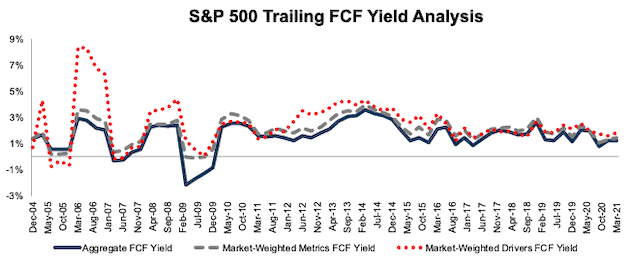

SP 500 FCF Yield Rebounds In Q1 2021. The trailing FCF yield for the SP 500 fell from 2 at the end of 2019 to 12 as of 32321 the earliest date 2020 annual data was provided by all SP 500 companies. On the trailing twelve months basis SP 500 s pace of cumulative 12 months Free Cash Flow growth in 4 Q 2021 accelerated to 4792 year on.

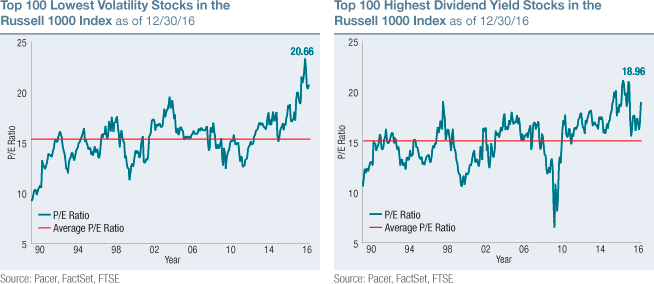

Free cash flow yield offers investors or stockholders a better measure of a companys fundamental performance than the widely used PE ratio. SP 500 Dividend and Free Cash Flow Yield Index. SP Global Price to Free Cash Flow Ratio 2010-2021 SPGI.

The free cash flow yield is the total free cash flow market capitalization. The trailing FCF yield for the SP 500 rose from 08 in 2Q20 to 19 as of 81821. The recently launched SP 500 Dividend and Free Cash Flow Yield Index combines dividend yield and free cash flow yield in the constituent selection process.

The trailing fcf yield for the sp 500 fell from 2 at the end of 2019 to 12 as of 32321 the earliest date 2020 annual data was provided by all sp 500 companies. The trailing FCF yield for the SP 500 rose from 11 at the end of 2020 to 16 as of 51921 the earliest date 2021 Q1 data was provided by all SP 500 companies. The index Launch Date is.

Free cash flow yield is really just the companys free cash flow divided by its market value. For more information on how our historical price data. The trailing FCF yield for the SP 500 rose from 11 at the end of 2020 to 16 as of 51921 the earliest date 2021 Q1 data was.

Free cash flow yield is a financial solvency ratio that compares the free cash flow per share a company is expected to earn against its market value per share. Investors who wish to. 5 rows ETFs Tracking The SP 500 Dividend and Free Cash Flow Yield Index ETF Fund Flow.

1 Yr Return 483.

A Quick Look At The S P500 Free Cash Flow As Long As The Real Economy Remains On Track Expect Healthy Corrections Not Protracted Bear Markets Seeking Alpha

Equity Valuation From A Bond Perspective 5 Picks With Attractive Fcf Yields Seeking Alpha

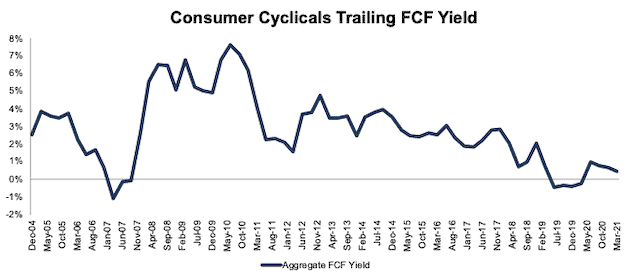

S P 500 Sectors Free Cash Flow Yield Through 4q20 New Constructs

S P 500 Sectors Free Cash Flow Yield Through 4q20 New Constructs

A Quick Look At The S P500 Free Cash Flow As Long As The Real Economy Remains On Track Expect Healthy Corrections Not Protracted Bear Markets Seeking Alpha

Break From The Herd Consider Free Cash Flow Pacer Etfs

Dividend Days Epoch Investment Partners Inc

S P 500 Sectors Free Cash Flow Yield Through 4q20 New Constructs